Award-winning PDF software

When to file 211 Form: What You Should Know

This change is to be effective as of July 3, 2020. A change from one year to the next year can be effected at the work site only. To ensure that your changes to Form 1128 are approved, you are encouraged to complete, sign and retain a Change in Tax Year — IRS Form 1128 — YouTube, (YouTube · Jan 2, 2020) A change can be effected either at the worksite of the Requester or by signing and submitting Form 1128 at any California DMV (YouTube · Jan 2, 2020) and following the instructions. As a result, you must be willing and able to be present and available to receive your new tax year's (YouTube · Aug 20, 2017) tax returns and pay all tax due in a change year in one week or less. Before sending the amended tax return, it is important that you keep a record of your change and continue to provide proof to ensure that your tax returns are properly filed. Form 1128 requires you to provide the following to the California government: The name, residence address, and employer's name(s)/partnership(s) of the person making the requested change. Also, if any of the change is made within a partnership, the partnership tax returns must be changed as well. The reason(s) for requesting the change in status. How and if the request will be accomplished. (e.g., the name and address of the person to whom the request is made) Any relevant information which indicates that: 1. The taxpayer has suffered or will suffer personal loss as the result of the making of the request. 2. The change is necessary to avoid double taxation. 3. The benefit is in the public interest. 4. The change is for an amount which is in excess of 5000. 5. All changes made under the authority of this subdivision shall be subject to the State Tax Law. 6. The change does not violate the provisions of the United States Supreme Court Taxpayer Rights Protection Act. 7.

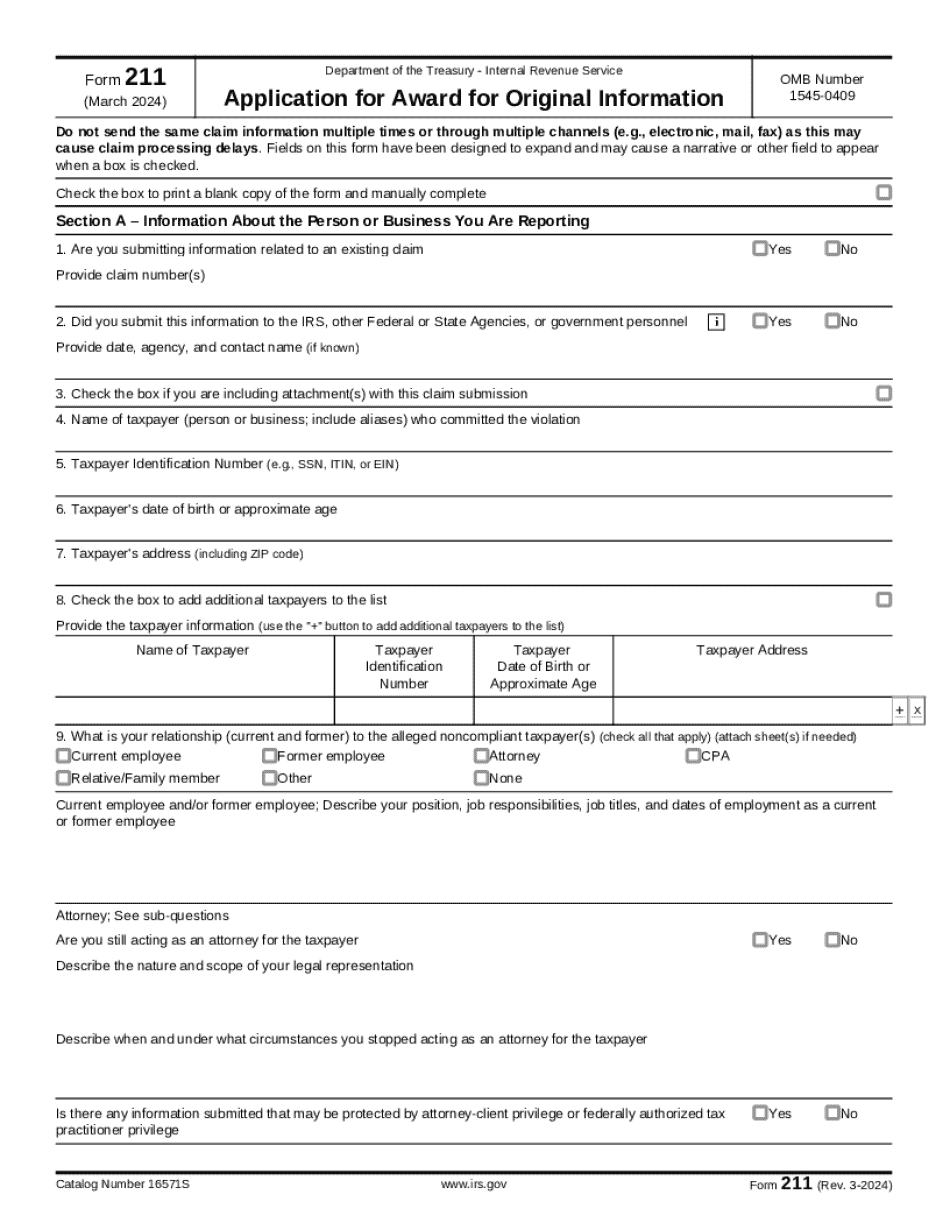

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 211, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 211 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 211 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 211 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.