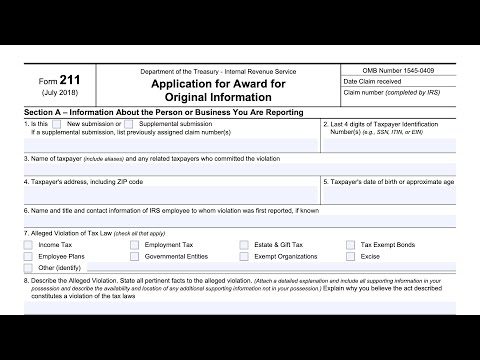

So we'll be going over IRS form 211 application for award for original information so this is the form that the IRS whistleblower office uses to process information reported to them about alleged tax abuse violations of tax law and under Internal Revenue code 7623 the federal government is authorized to issue monetary rewards for information that lead to the recruitment of lost tax funds so basically a whistleblower complaint that leads to a monetary recovery and Under 7623 The Whistleblower and it mentioned is eligible for a monetary compensation and the amount of compensation determined is determined by a couple of factors one the amount of taxes that are at stake two how relevant their information is to recouping that money and uh and also uh most importantly uh the you know the nature of the violation uh whether or not uh this was key information whether it was the only whistleblower involved uh things of that nature so basically if you feel like you're giving the IRS information that they're going to be able to use to recoup a significant amount of tax money then you can file this form and you may be entitled to part of that award the IRS whistleblower office does have a little bit more information on their website specifically on claim eligibility and I'll go over that really quickly and what kind of information needs to be on this form so a couple things and then we'll dive into the form itself the the form when you complete it should be able to completely describe the alleged tax non-compliance you're going to need to actually write down what happened you should be able to provide enough information uh to support what you're saying so if you have records copies of books Ledger...

Award-winning PDF software

How to prepare Form 211

About Form 211

Form 211 is a document that broker-dealers use to request permission from FINRA to quote or trade over-the-counter (OTC) securities on behalf of their clients. This form is required by the SEC and FINRA to ensure compliance with anti-fraud and anti-manipulation rules. The main purpose of Form 211 is to provide transparency and protect investors from fraudulent or manipulative practices. It requires the broker-dealer to disclose all material information about the issuer and the securities they are proposing to quote or trade. Additionally, the broker-dealer must demonstrate that they have performed due diligence on the issuer and that the securities are suitable for their clients. Broker-dealers who wish to quote or trade OTC securities on behalf of their clients are required to submit Form 211 to FINRA. Issuers themselves cannot submit Form 211. Only registered broker-dealers can submit this form.

What Is Irs Form 211?

Online technologies help you to arrange your document administration and enhance the efficiency of the workflow. Look through the brief guide so that you can fill out Irs Form 211, avoid mistakes and furnish it in a timely way:

How to complete a 211 Form Irs?

- On the website with the blank, click on Start Now and go for the editor.

- Use the clues to fill out the relevant fields.

- Include your individual details and contact information.

- Make sure you enter correct information and numbers in appropriate fields.

- Carefully check the content of the document so as grammar and spelling.

- Refer to Help section should you have any issues or contact our Support staff.

- Put an digital signature on the Form 211 printable with the help of Sign Tool.

- Once document is completed, press Done.

- Distribute the ready blank by using email or fax, print it out or download on your gadget.

PDF editor makes it possible for you to make modifications to the Form 211 Fill Online from any internet connected gadget, customize it in keeping with your requirements, sign it electronically and distribute in different approaches.

What people say about us

The best way to fill in templates without mistakes

Video instructions and help with filling out and completing Form 211