Award-winning PDF software

Otcbb market maker requirements Form: What You Should Know

The form must contain a current description of the company and its products by market maker and must include a statement that, if the company is a market maker, a written notification shall be sent to FINRA to notify us in writing that the company has completed the requirements for listing on the OT CBB. 1. 3. 6 (within 90 days) ; Price Quotes by Market Ma… 1st Amendment and Other Amendment to Company Registration Statement for Glendale Securities, Inc. (b) First Amendment The registration statement for Glendale Securities, Inc., a New York corporation, is hereby amended as follows: a. By removing the words “market maker” and placing in place the following description of the company: a. For this purpose, the term “market maker” refers to any person who buys and sells, under various trading arrangements, all or part of the securities in a single trading day or in a few consecutive trading days, and who places the securities for sale on or over any exchange or market (“market”), where such person uses in either case the information obtained from a trading computer application to select securities for sale on or over such exchange or market, as follows: b. By adding a reference to the words “a continuous over-the-counter market” to the company's current registration statement (or a modified registration statement of a company with regard to the same or other exchanges); or c. By adding a definition of “market” as follows: a. A continuous over-the-counter market means that all the securities in a single trade or transaction are traded, for reasons that are not materially related to other securities, across the entire trading facility; b. An “over-the-counter” price (which is synonymous to an “over-the-counter” price) is an amount of the securities that are sold, bought, or sold within a few seconds after settlement on a public stock exchange, with or without commissions, under an agreed upon transaction value, unless the exchange's rules exclude such a transaction or require that the transaction take place at the market price. (For purposes of this definition, “over-the-counter” means any transaction where the broker's firm or other intermediary controls the trading and holds all knowledge of the underlying securities.) c.

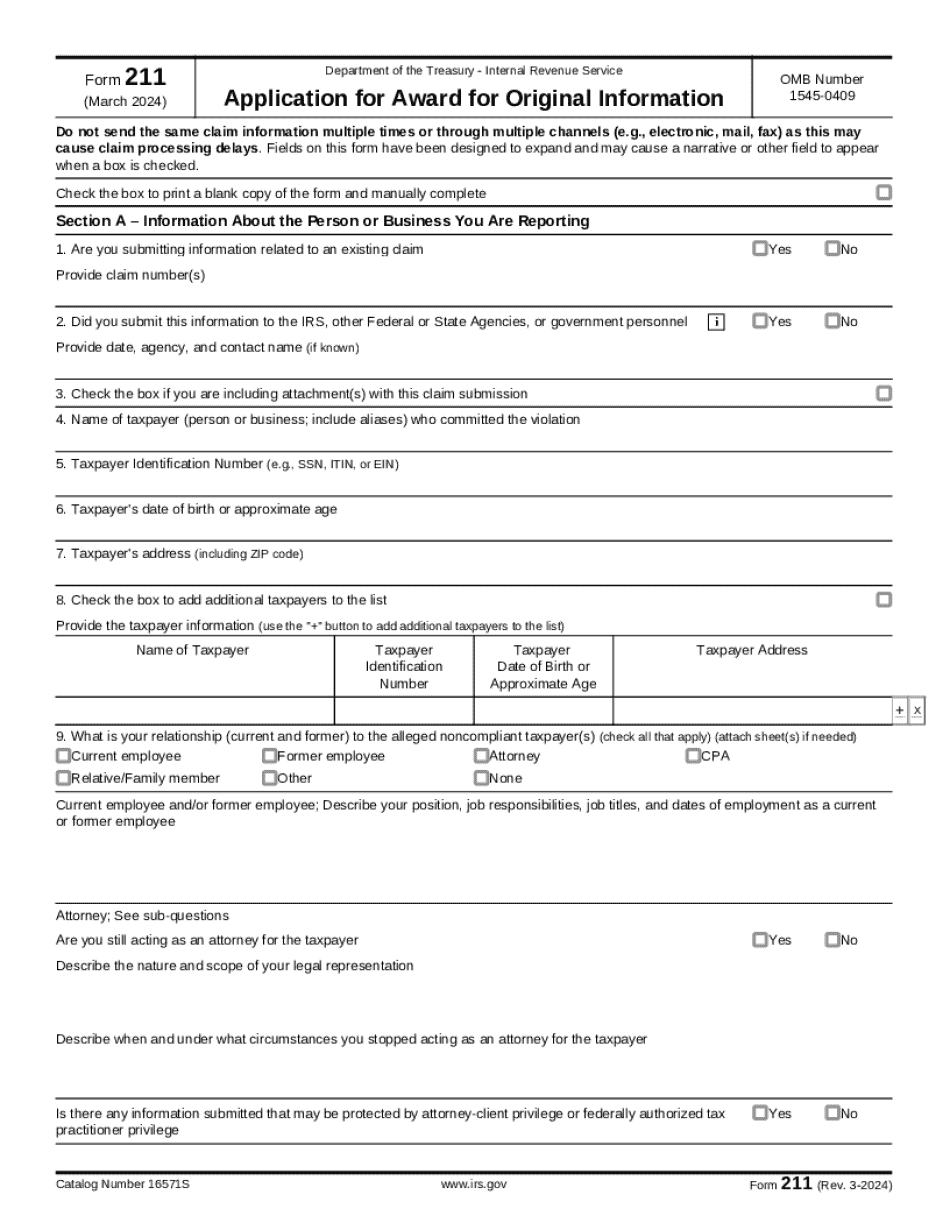

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 211, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 211 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 211 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 211 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.