I'm attorney Laura Anthony, founding partner of Legal & Compliance, a full-service corporate securities and business transactions law firm. Today is the final lawcast in a series discussing NASDAQ listing requirements. There are many benefits to trading on an exchange such as NASDAQ. The biggest benefit to an exchange is the ability to attract analyst coverage and institutional investors, and the corresponding increase in liquidity that comes with both. Stocks that trade on NASDAQ tend to have a lower bid-offer spread than over-the-counter securities, again encouraging trading volume and liquidity. Importantly, exchange-traded securities are exempt from the penny stock definition, allowing for more market maker and broker-dealer participation. A broker-dealer cannot recommend a penny stock transaction to its retail customers, and therefore no analyst, financial advisors, or institutional investors make recommendations for purchases of penny stocks. In general, no institutional investors invest in penny stocks. As an aside, this is one of the reasons that OTC Markets created the OTCQX market tier, which does not list penny stocks. It is also the reason that the small and micro-cap industry is pushing for a supported venture exchange. A designated venture market would be one for small-cap companies, which would allow for higher brokerage and trading commissions, be exempt from the prohibitive penny stock rules, and which securities would be considered coverage securities under federal securities laws and thus exempt from separate blue sky compliance. I think that the OTC Markets has the foundation to set the OTCQX as a recognized venture exchange platform and would love to see it gain regulatory support in that regard, including blue sky preemption. In today's world, it is increasingly difficult to deposit and/or trade in non-exchange-traded securities. Despite the congressional efforts and SEC rulemaking in support of small and micro-cap capital formation, for example, the...

Award-winning PDF software

Is the otc market a national securities exchange Form: What You Should Know

The OTC Link is one of the world's only OTC electronic exchanges, offering price quotes to nearly 20,000 securities, securities firms and securities products. OTC markets have both an OTC trading floor for over-the-counter securities and an electronic quotation system (ERP) that supports trading at over 100 regional exchanges. An OTC transaction may be facilitated by an OTC broker in a separate ETP or through an electronic quotation service (ES) which allows a broker access to price quotes on major exchanges in the United States. OATS: Over-the-Counter Market OATS: Over-the-Counter Market, or Over-the-counter Stock Market OATS: Over-the-Counter Market, or Over-the-counter Stock Market Over-the-counter market: 1. Trading in securities, such as securities, commodities, foreign currencies, etc., over-the-counter (OTC), on an over-the-counter (OTC) basis rather than on the traditional open-ended stock and fixed income markets. 2. Any market where securities, commodities, foreign currencies, etc., are sold, owned, traded, bought, etc. over the counter: “trade in securities, buy, sell, own, trade, buy (otherwise called OTC activity, OATS) etc.” 3. Trading through a network of dealers, who act as a liquidity provider to trade by acting as exchanges, open at open interest, and acting as price transmitters. OATS Financial Market (OATS) Source — OATS Financiers OTC Link: OTC Link The Overthe-Counter Information Exchange Trading System (Oats Link) is a financial information system designed to provide access to over-the-counter (OTC) securities trading and trading information, on a national securities exchange, with access to over 100 regional exchange markets. OTC Market: Over the Counter. OTC Market : a national stock exchange, or OTC Market, that enables investors to trade in exchange for an over-the-counter (OTC) security. The Over the Counter Market (OTC) allows securities trading of over-the-counter (“OTC”) securities through a network of dealers, who act as a liquidity provider to trade by acting as exchanges, open at open interest, and acting as price transmitters.

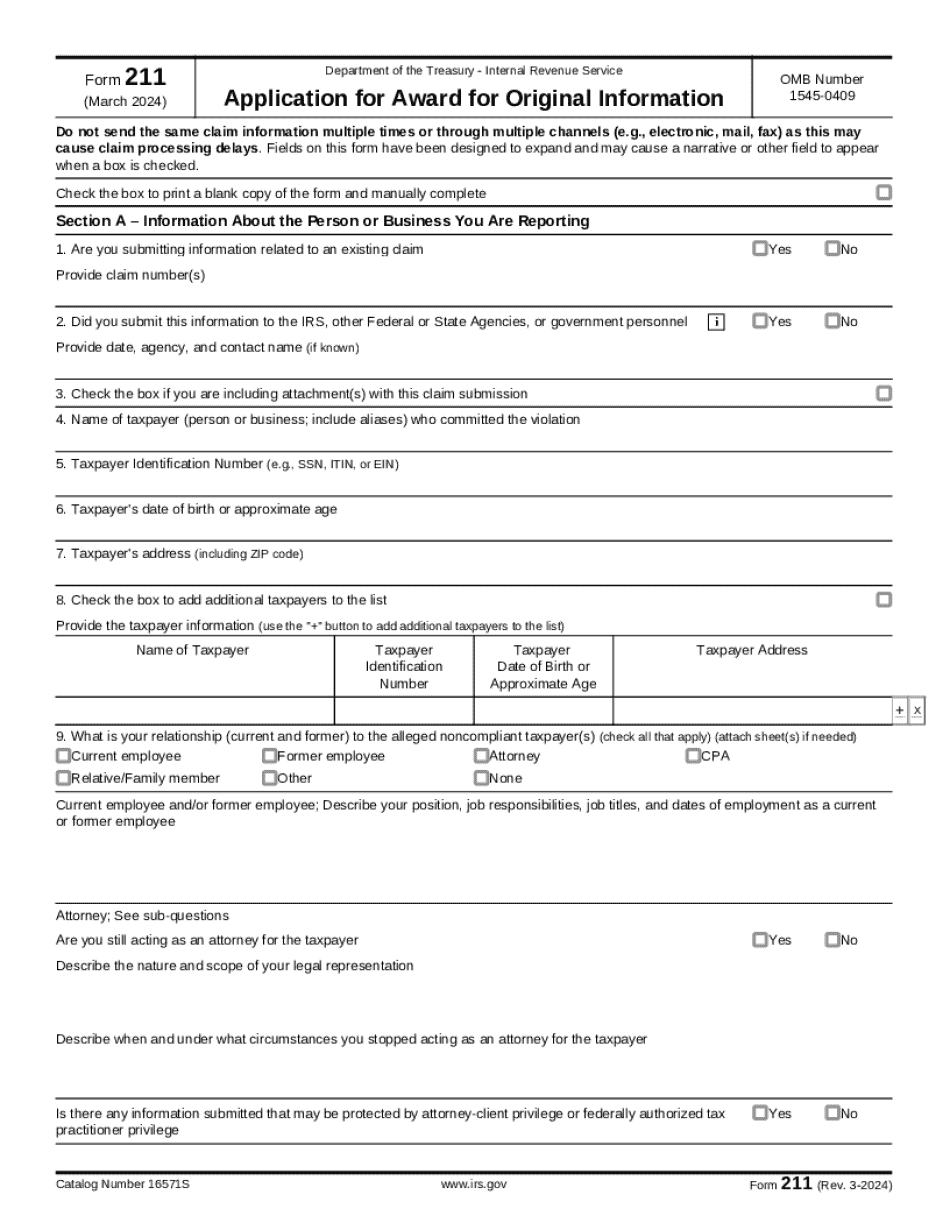

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 211, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 211 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 211 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 211 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Is the otc market a national securities exchange