Award-winning PDF software

Otcbb stock list Form: What You Should Know

OTC Market News In the past few years, there has been tremendous growth in OTC financial services. Today, the OTC market is so much broader — it encompasses any securities traded over a counterparty-to-counterparty electronic platform. That has brought investors with more opportunities than ever before for direct trading. For instance, there are a lot of people who trade stocks in the US stock market. What Is the “Over-The-Counter Markets?” According to the Office of the US Trade Representative: Over-the-Counter Markets are established within an electronic exchange for two people, including oneself. They provide markets for securities in a market that is open to all persons. They are also referred to as an electronic trading system, over-the-counter (OTC) marketplace, and OTC swap marketplace. OTC markets offer a direct trading and purchase method for securities and other market-making transactions without a middleman involved in the transaction. They differ from Securities Markets and Clearing Programs, which offer exchange trading for securities and provide an intermediary and clearing function in the process. The main difference between the OTC markets and the Securities Markets and Clearing Programs is that in the OTC markets, the seller does not have a direct relationship with the buyer. The result is a direct price comparison and not a middle man. There is no requirement for the security to be listed in a securities exchange, and therefore no exchange commissions. In the OTC Markets, the exchange does not act as the middle man, so the security does not require a capital raise in order to be listed. As of October 9, 2010, more than one million US securities are listed in 21 OTC markets. Fee Structure All major exchanges in the US have fees which are used to pay OTC brokerages, clearing houses, and other entities for the services they provide to the public. These fees cover the costs of managing the OTC markets for the public. The OTC fees are not as high as the fees typically charged in the exchanges, but they are still a large sum which is passed on to the public in exchange for the privilege of trading the over-the-counter securities.

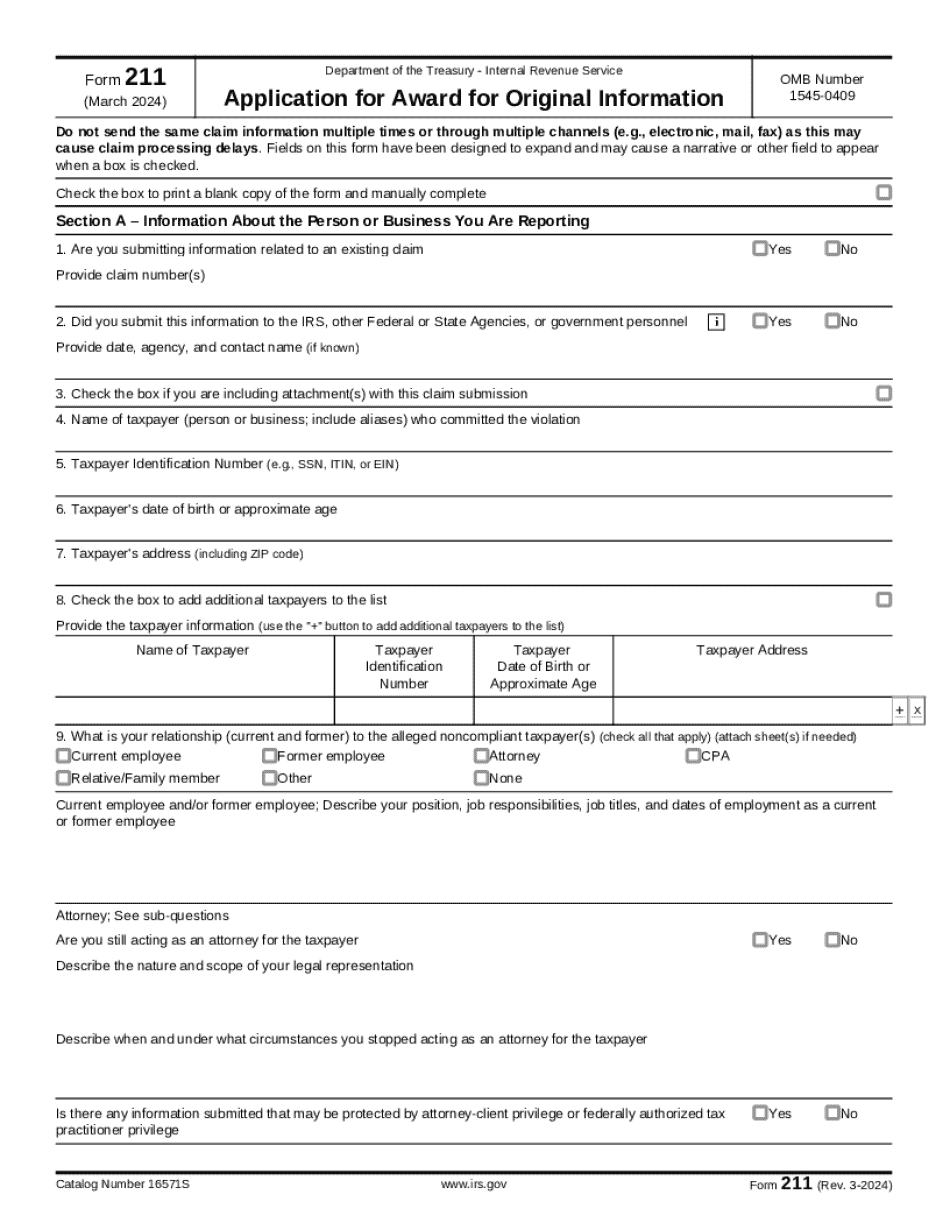

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 211, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 211 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 211 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 211 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.