Award-winning PDF software

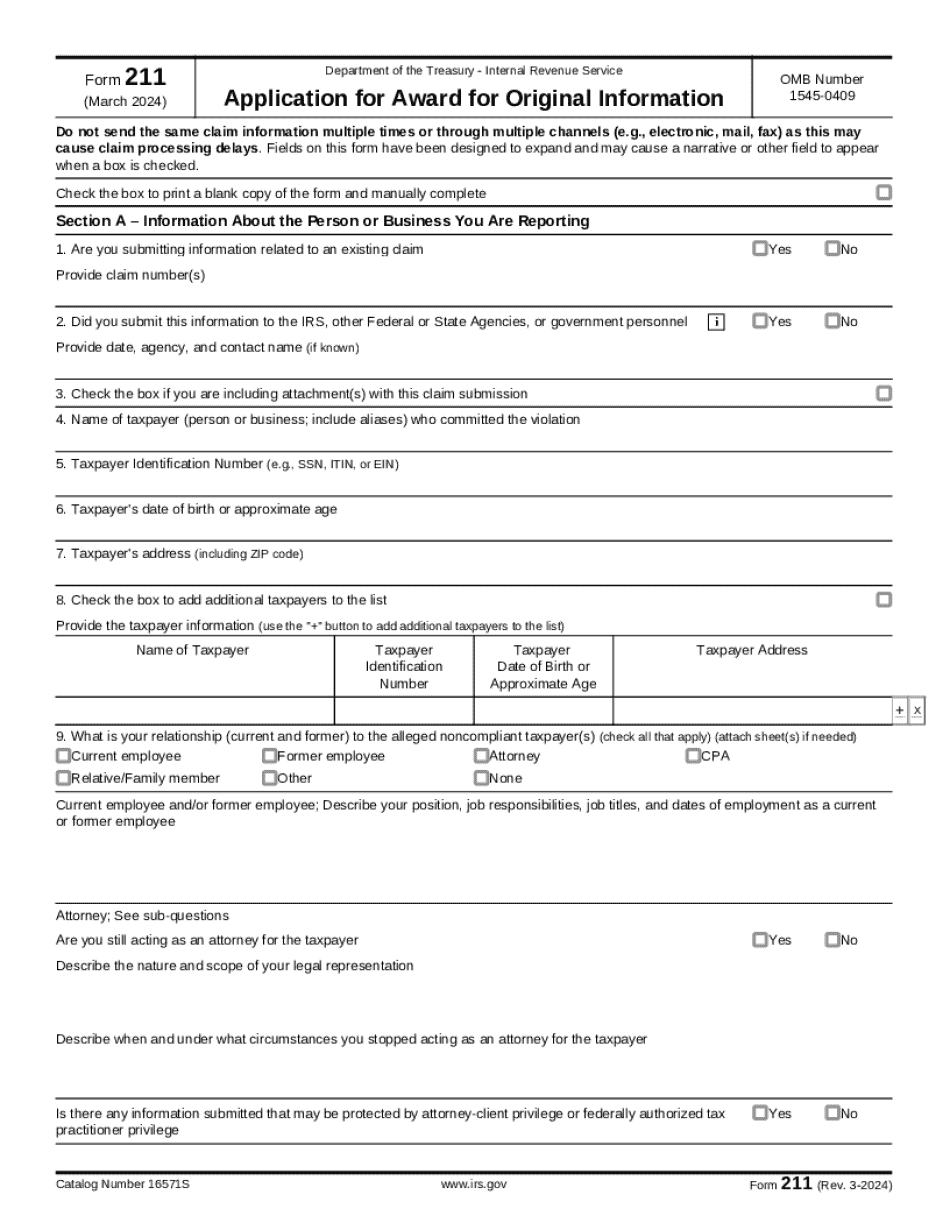

Form 211 Arlington Texas: What You Should Know

IRS Form 2202; NOV 12, 2015–17, JUNE 14, 2025 — due date varies Note the new due dates for both the Form 2202 and Section 179 Deduction. IRS Form 2210–A; NOV 15, 2017–2021 ; JUNE 14, 2025 — due date varies. This form is for all vehicles of the same make and model in excess of 10 tons. If the vehicle is subject to a tax in any state, a separate form must be filed IRS Form 2290-1; DECEMBER 16, 2022–2023 — due date varies for the tax period beginning in January 2023. IRS Form 2290-2A; JANUARY 28, 2025 — due date varies for the tax period beginning in January 2023. IRS Form 2202 – JULY 16, 2025 ; DECEMBER 15, 2022—due date varies For the entire tax period beginning January 15, 2019, through April 15, 2021, use the current tax period and add the federal tax in your state at the rate of 6.0%. The federal tax in California is 4.45% on the sales of motor vehicles. Note: the new federal tax of 11.4% applies beginning October 1, 2019, and is to ensure the integrity of the nationwide Sales Tax Agreement and is in accordance with Section 1254 of the Internal Revenue Code. In-State Taxpayers In-State Motor Vehicle Users If your vehicle was purchased in or outside the United States, you are not required to report the sales tax, either at the time you place it into service or before you file a tax return. However, if your state reports the sales tax separately on your return, report that separately. If you are a nonresident who is required by law to collect sales tax and is subject to in-state taxes, report the in-state taxes separately. In-State Motor Vehicle Users, Sales Only & Out-of-State Motor Vehicles Sales tax that is not reported on the tax return is considered a business sale (Section 20-1021(a)(1)) and is subject to California VAT (VAT on sales of passenger cars & trucks, which is calculated based on the purchase price). The amount is included in the calculation of the tax due (see the “Calculation of the Taxes Due” section of this article).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 211 Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 211 Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 211 Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 211 Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.